SymCRG

Commercial Real Estate Investment & Advisory

SQ FT SOLD/LEASED

PROPERTIES SOLD/LEASED

TOTAL TRANSACTION VALUE

How Can We Help

Comprehensive commercial real estate solutions for investors, landlords, and tenants

Representation

Comprehensive representation services for both landlords and tenants. We provide expert leasing services, negotiate favorable terms, and maximize property value across Industrial, Residential Development, and Retail sectors.

Learn More→“Let us show you how rich you really are.”

Broker Opinion of Value

Complimentary valuations backed by deep market knowledge. No commitment required.

Learn More→Advisory Services

Strategic real estate consulting for portfolio optimization, market entry, and development feasibility. Our advisory team provides data-driven recommendations for complex decisions.

Learn More→Why Choose SymCRG?

SQ FT SOLD/LEASED

Our boutique approach and extensive network deliver personalized solutions and unmatched results.

PROPERTIES SOLD/LEASED

Deep market expertise across all five NYC boroughs and beyond.

Years Experience

With over 30 years' experience, we see deals through and get the best results for our clients.

Completed Deals

Featured transactions by the principals of SymCRG spanning development sites, investment sales, and commercial leasing across NYC's five boroughs.

158-02 Northern Boulevard

Flushing, Queens

Represented the developer in this future 80,000 SF, 99 unit residential development site in the thriving area of Flushing, NY.

15-08 College Point Boulevard

College Point, Queens

Represented the Landlord. 12,000 SF retail space with 5,000 SF parking. Long-term lease value.

122-03 14th Avenue

College Point, Queens

Sold a decommissioned Bank of America in a closed bid auction. Subsequently sold the adjacent property to create a 20,000 SF plot, rezoned and development begins in 2028. 81,580 ZSF development potential.

37-31 10th Street

Long Island City, Queens

Represented buyer in bank auction. Property had been previously sold for $10.2M; the new buyer sold it for $4.85M 18 months later.

39-16/22 23rd Street

Long Island City, Queens

Represented the landlord. Maximized value by dividing the space and leasing to 2 tenants at top of market.

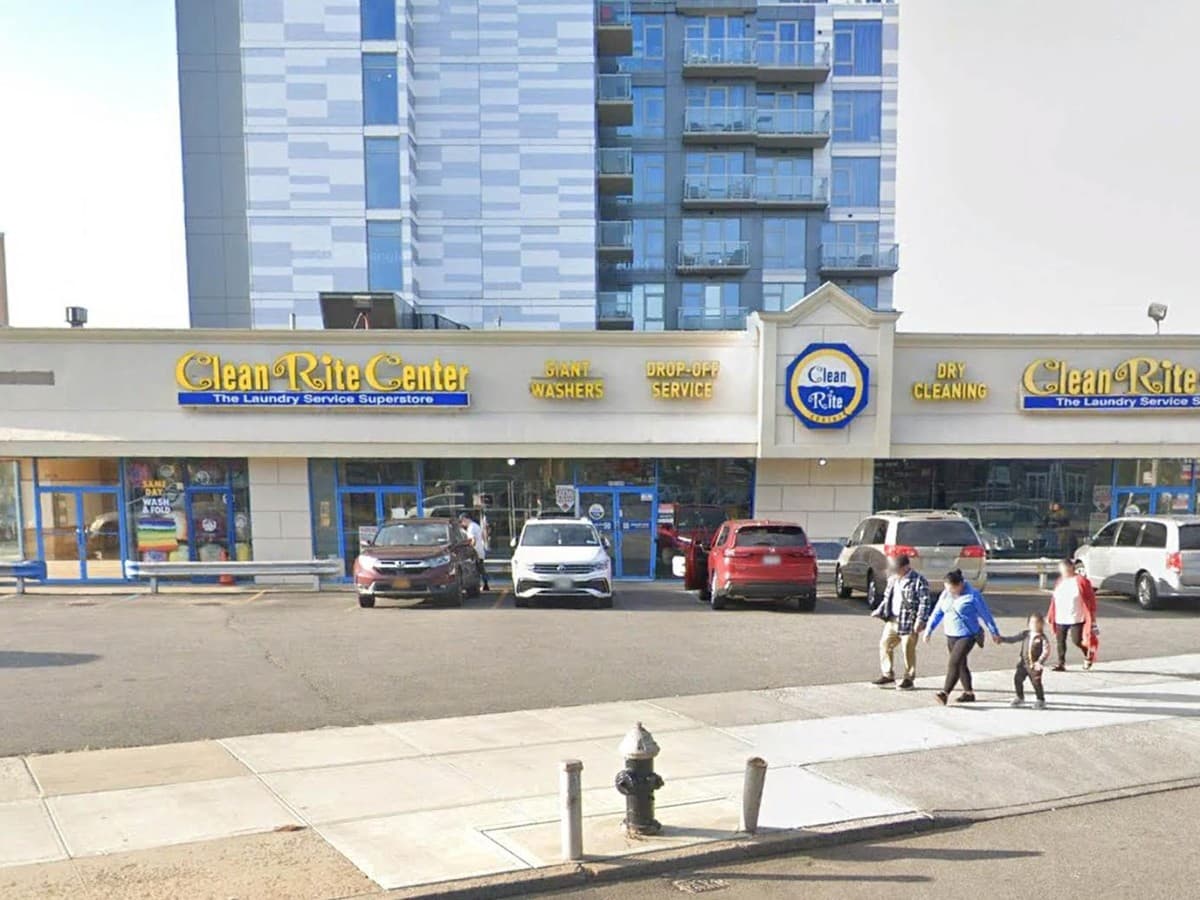

41-17 Broadway

Astoria, Queens

Value-add site. Full renovation turned defunct hardware store into 2 retail spaces and 2 apartments, fully stabilized within 4 months.

47-39 35th Street

Long Island City, Queens

Represented the landlord in this industrial lease to a well known trending candy company, Bon Bon.

6301 12th Avenue

Borough Park, Brooklyn

Represented the buyer in one of the largest infill sites sold in Brooklyn in decades. 140,000 SF plot owned by the Sisters of Mercy for over 100 years, subsequently divided into 4 parcels and sold to residential and education institutions totaling 400,000 SF of development.

59-43 56th Road

Maspeth, Queens

Represented the buyer in this 2-stage assemblage purchase. 7,500 SF and 5,000 SF land deal. 27,820 ZSF development potential for a large multilevel industrial building.

21-17 37th Avenue

Long Island City, Queens

Represented the landlord on this industrial lease.

51-30 Roosevelt Avenue, 2nd Floor

Woodside, Queens

Represented the landlord in leasing community facility floor to Child Center of NY on a long-term build-to-suit lease.

50-18 Roosevelt Avenue

Sunnyside, Queens

Represented buyer in this off-market stabilized retail sale.

266 Seigel Street

Bushwick, Brooklyn

Leased 30,000 SF to Netflix.

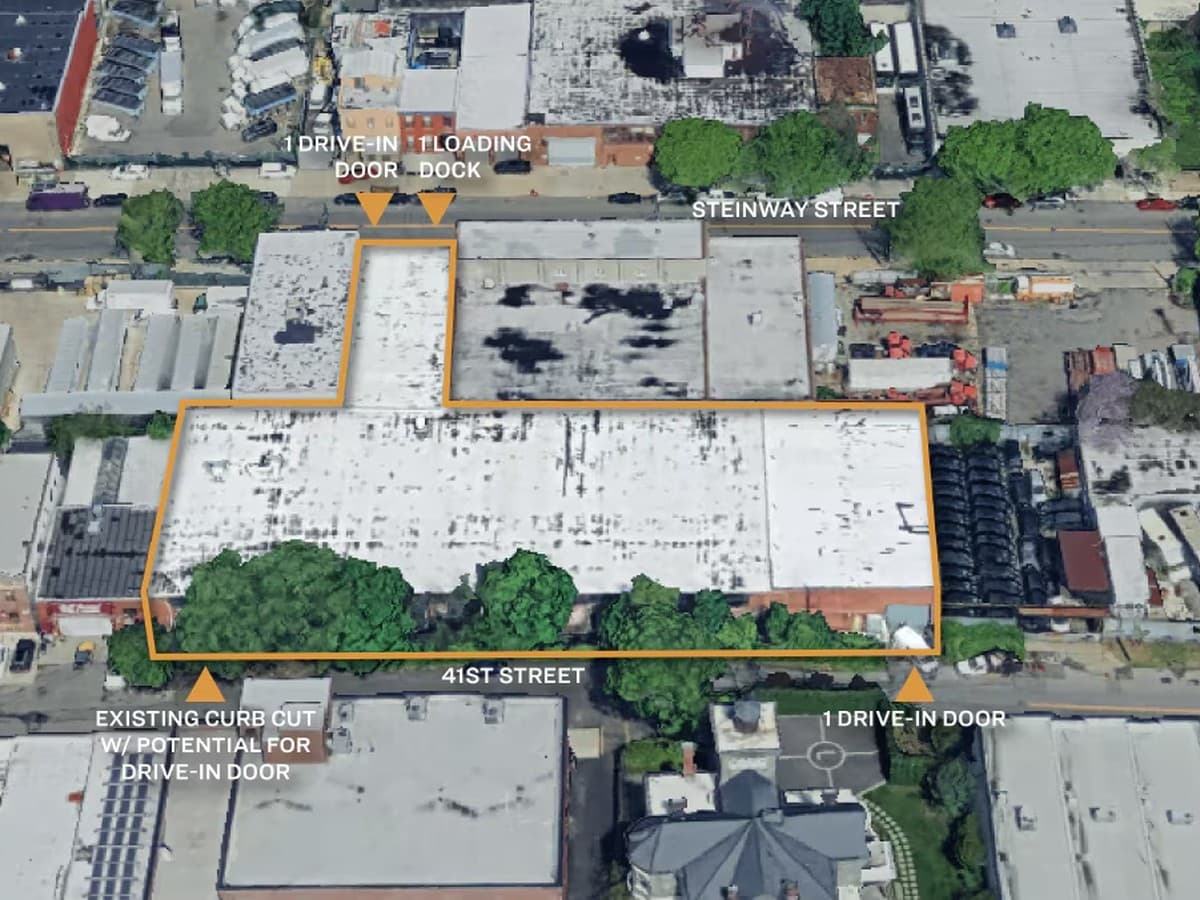

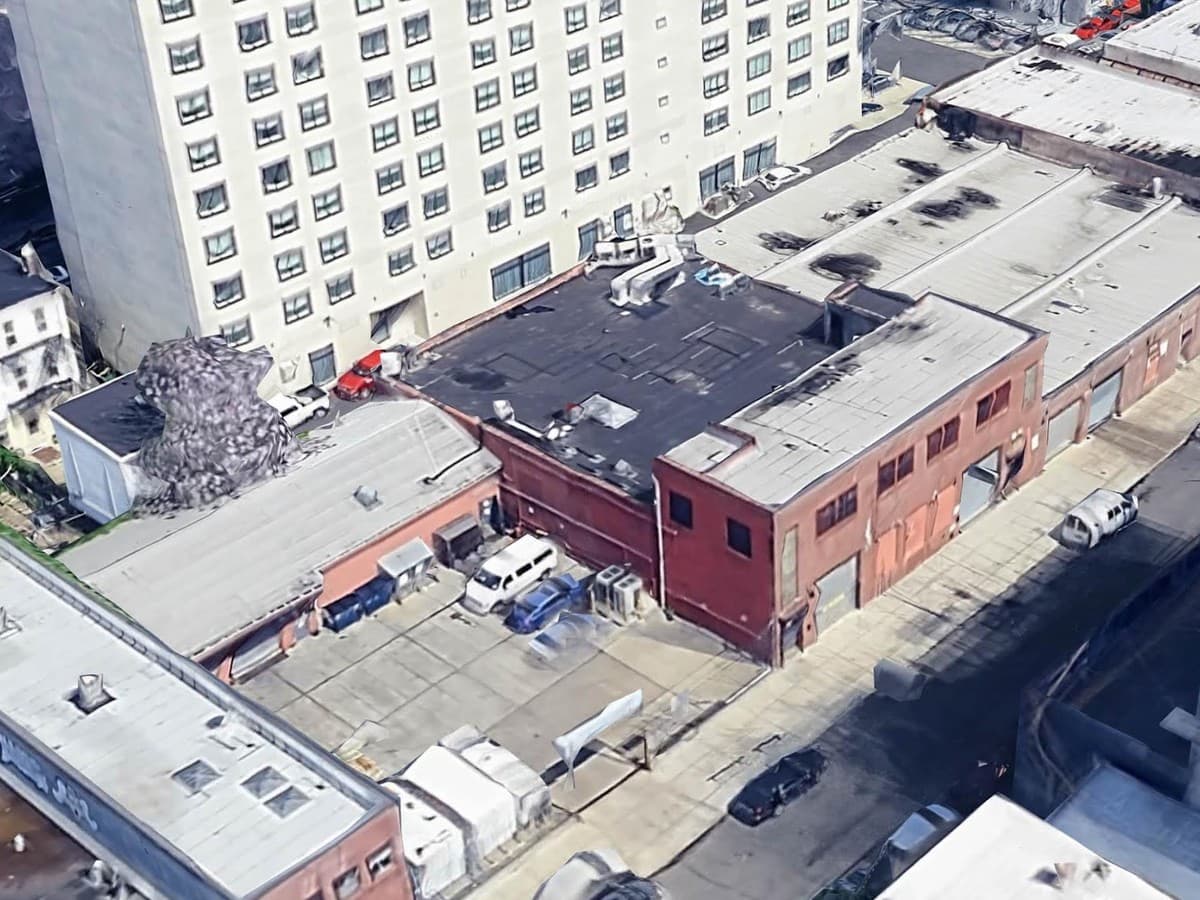

1845 Steinway Street

Astoria, Queens

Represented the landlord in leasing 33,000 SF to a lab testing company during the pandemic for quick swab tests.

1940 42nd Street

Sunset Park, Brooklyn

Represented the landlord in a long-term FDNY lease. Off-market deal securing much-needed space for FDNY operations.

741 61st Street

Sunset Park, Brooklyn

Represented the developer who went on to develop a medical facility and hotel.

51-36 35th Street

Long Island City, Queens

Originally sold the house on a 5,000 SF lot, then developed into industrial building and leased to 3D Lab at top dollar. Buyer later expanded with adjacent property.

38-40 10th Street

Long Island City, Queens

Leased 20,500 SF food prep building to high-end coffee roaster.

835 40th Street

Sunset Park, Brooklyn

Represented the buyer who turned this site into a KTV karaoke studio still operating today. Originally structured as lease with option to buy.

5118-5124 Roosevelt Avenue

Woodside, Queens

Represented buyer as part of an assemblage totaling 68,150 SF residential mixed-use with retail and community facility floor with Child Service of NY as tenant.

249-257 E. Sandford Boulevard

Mount Vernon, Westchester

Lease with option to buy to Ace Natural, a food processing and delivery company.

13-06 43rd Avenue

Long Island City, Queens

Represented the buyer who moved location with a 1031 exchange from Manhattan to LIC. Property falls in the LIC One zone slated for rezoning.

2417 3rd Avenue

Mott Haven, Bronx

Represented both buyer and seller in this adaptive reuse industrial-to-office conversion in the emerging South Bronx market. Developer went on to sell the property for $64M four years later.

2095 Flatbush Avenue

Flatlands, Brooklyn

Represented the buyer in this 1031 exchange used to purchase this STNL asset.

Featured Case Studies

Largest Infill Site Sold in Brooklyn in Decades

Borough Park, Brooklyn

Undisclosed

Price

400,000 SF

Development

Block-Wide Assemblage to 216,000 SF Development

Woodside, Queens

Undisclosed

Price

216,000 SF

Development

Industrial to Office Conversion in South Bronx

Mott Haven, Bronx

$30M → $64M

Appreciation

150,000 SF

Building SF

News & Market Intelligence

Research, transactions, and industry insights to inform your real estate decisions

Industrial Real Estate Demand Surges in Brooklyn and Queens

Last-mile logistics and e-commerce growth are driving unprecedented demand for industrial space in outer boroughs.

Market Reports

Q3 2025 Outer Borough Industrial Market Report

Vacancy at 6.2%, food manufacturing & 3PL driving demand

Q3 2025 Manhattan Office Market Report

Class A leasing at 30-year high, vacancy falls to 22%

H2 2025 Manhattan Retail Market Report

SoHo rents surge 19% YoY, vacancy lowest since 2017